Understanding section 179

Grow Your Business & Save MoneyGet your business ready to grow!

Section 179 + Affordable Capital = Continued Success

30 Fixed Commercial Property Loans

Revenue based money available for less than perfect credit

BREAKING NEWS:

IN 2021.

WHAT IS SECTION 179?

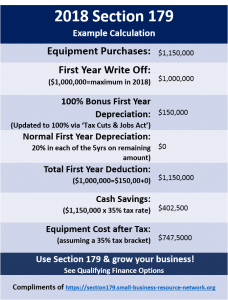

Simply put, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. This means that if you buy (or lease) a piece of qualifying equipment, you can deduct 100% the purchase price from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves. This lowers your business’ taxable income. Learn more…about writing off up to $1,000,000

Did you know…

You can use affordable working capital to purchase all of your qualifying property (i.e. computers, software, even vehicles) and then use Section 179 to deduct the cost of the purchase and lower your tax bill.

Question

How fast can I get the money in my account?

Answer:

With just one online submission, The Network can provide you with multiple offers that match your current needs.

The submission process is free, fast, easy and secure!

Almost all types of “business equipment” qualify! Section 179 was created in part, to try and foster growth in small business.

All businesses need equipment on an ongoing basis, whether it’s machinery, computers, software, office furniture, vehicles, or other tangible goods. Your business will purchase many of these goods during the year, and will do so again and again. Learn more about qualifying property.

Did you know…

Purchasing equipment is a revenue generating activity that can make your business more profitable.

Question

Is there a lot of documentation needed?

Answer:

For traditional finance you’ll need full documentation. However, the Network has access to revenue based finance terms that have helped out clients in the past. When you submit via our Secure Online Submission Center we provide offers for what your eligible for based on the documentation you’ve submitted.

The submission process is free, fast, easy and secure!

Your company will more than likely be able to use Section 179 for all of your purchases, however, there are some purchases that may not qualify. Vehicles, computer software, office furniture (desks, tables and chairs) will qualify. Consult your tax professional or IRS.gov for a more extensive list.

DOES COMMERCIAL PROPERTY QUALIFY?

To qualify for the section 179 deduction, your property must have been acquired for use in your trade or business. Property you acquire only for the production of income, such as investment property, rental property (if renting property is not your trade or business), and property that produces royalties, does not qualify.

Learn more about non qualifying property.

Did you know…

You can also deduct the cost of capital. Most business owners do not know that they can acquire capital to use for these purchases and enjoy these deductions.

Question

I want low cost capital to make my purchases. Is the online submission process secure and confidential?

Answer:

Yes. The data is transmitted via AES 256 SSL encryption. Providing you with options from multiple lenders is what we do. With just one online submission you can choose what you want. We have traditional and alternative lenders in our network.

The submission process is free, fast, easy and secure!

Section 179 Deduction is very easy to use!

A small or medium-sized business owner who has purchased, financed or leased equipment and placed it into service during the calendar year, should take the Section 179 Deduction to benefit from a lower tax bill “a.k.a” tax savings. Learn more about actually using Section 179.

Did you know…

Software purchases and company computers are all considered qualifying property.

Question

What if I need additional capital?

Answer:

We’re here to help. Once you’ve established yourself with a lender from our network, you’ll deal directly with them for additional capital requests. The online application is a “step-by-step” process designed to get you fully submitted in one 5–10-minute session.

The submission process is free, fast, easy and secure!

Here you can download a copy of the needed forms and the accompanying instructions.

Here you can download a copy of the needed forms and the accompanying instructions.

You can also visit the IRS website for more information.

ADDITIONAL RESOURCES YOU MAY FIND HELPFUL

- All Form 4562 Revisions

- Publication 463, Travel, Entertainment, Gift, and Car Expenses

- Publication 535, Business Expenses

- Publication 542, Corporations

- Publication 551, Basis of Assets

- Publication 946, How To Depreciate Property

- Other Current Products

Business expenses are the cost of carrying on a trade or business. These expenses are usually deductible if the business operates to make a profit.